| Published monthly by Dow Gold Ratio Strategy Group This newsletter covers the strategy along with economic comments. To subscribe, visit Dowgoldstrategy.com or email: dowgoldratiostrategy@gmail.com |

| [Pick the date] August 2020 |

March 15, 2021

Where we stand

| INDEXES S&P 500:$Gold Recovering Dow 30:$Gold Recovering QQQ:$Gold Up hOLD QQQ, FNGU, or tqqq sell your gold for QQQ/TQQQ/FNGU |

BULL OR BEAR? – BULL

The $INDU:$Gold ratio chart has been going down since back in 2019. However, it is has been turning up to where it might cross up within a few months. The $SPX:$Gold chart looks very similar. On the other hand the QQQ:$Gold chart has been in the plus column since way back in 2012.

As the only index:Gold ratio chart where the 220 is above the 440 day EMA, we have been owners of the Nasdaq 100 since 2012.

WHAT TO OWN – FNGU/TQQQ/QQQ

Depending on your risk tolerance, that could mean the 1X version, QQQ, or the 3X version TQQQ. If you really want to turbocharge your risk and return, there is FNGU.

While technically not a Nasdaq 100 product, it almost perfectly correlates to TQQQ though FNGU only has 10 positions. Five of them are in QQQ/TQQQ and five are not.

The QQQ type ETFs had a gangbuster year last year and were on track to do so this year until this recent selloff occurred.

As we are in a long-term sustained bull market, this little selloff was simply that. A selloff in a long-term bull market. During this little sale, I held my positions and bought as much more as I could stand.

In summary, we are in a bull market so don’t let small selloffs make you nervous. Hold on to what you own.

YEAR TO DATE PERFORMANCE (2/26/2021)

QQQ 0.13%

TQQQ -1.85%

FNGU 18.21%

$SPX 1.27%

WHY I BELIEVE WE ARE IN A BULL MARKET

The economy is recovering from the Covid anomaly. The Fed is stimulating with Quantative Easing (QE) with no slowing down in slight. Interest rates are at 40-year lows. Inflation is no where to be found. We are seeing “demand” running up prices but that is temporary and primarily due to Covid supply disruptions. The housing market is in a severe supply shortage as we drastically reduced new home starts way back in 2006 and we still are not producing what we did in 2006. That will take decades to work through. Biden just signed another Covid relief bill for $1.9 Trillion. And there is another potential $3 Trillion infrastructure bill following that. Money is flowing everywhere.

When the cost of capital is low (low interest rates) and there is a lot of it (see above), then the economy will roar. I have to say I’m as bullish as I have been since the early 1980’s. Oh yeah, and the charts say so too.

INFLATION

We are not seeing inflation. We may be seeing some temporary price increases due to supply interruptions due to Covid. The 12-month rate of inflation is only 1.68%. You are seeing price increases due to depressed prior prices though. Gasoline is up about 45% since last year. Put that in the context that they FELL 75% in 2020. An increase of 45% after a decrease of 75% means gasoline prices are still down. There are a number of examples just like that where the headline screams inflation, but prices are just getting back to where they were after a huge drop.

Housing is another item where you hear bubble. We are not in a housing bubble. We are in the greatest shortage of housing we have seen since the end of WWII. Beginning in 2006, new housing starts fell off of a cliff. We produced half the new homes we did in 2005. We still haven’t caught up to the level we were in 2006. All of those houses that did not get built are still not getting built. So the issue is not housing demand as much as it is too little supply. Realtor.com reported that the number of houses for sale back in December was half what it was in December 2019. It will take decades to fill the housing shortage.

As builders ramp up the demand for supplies to build houses has caused those prices to go way up. Lumber is the most dramatic example. I promise you we do not have a shortage of trees. As lumber prices continue to rise, Weyerhaeuser will cut more trees down and make more lumber. These lumber prices will eventually get back to normal levels.

PPO(65,250,22)

As you know, we use the 220EMA/440EMA on our major index ratio charts. The 220/440 is for our long term bull/bear market studies.

When it comes time to pick an ETF or a stock, I use the 65EMA/250EMA with a 22 day moving average. On Stockcharts, and elsewhere, this is known as the PPO (65,250,22).

This part is going to get kind of nerdy so bear with me. Remember this PPO crossing up is a buy signal and PPO crossing down is a sell signal.

PPO stands for Percent Price Oscillator. In a nutshell, it measures the difference between the two moving averages (the 65 and 250 in this case) and uses a 22 day (one month) moving average of that difference. The MACD is very similar except it measures the difference in points instead of percent. PPO lets you easily compare to one stock or ETF to another, while MACD falls short.

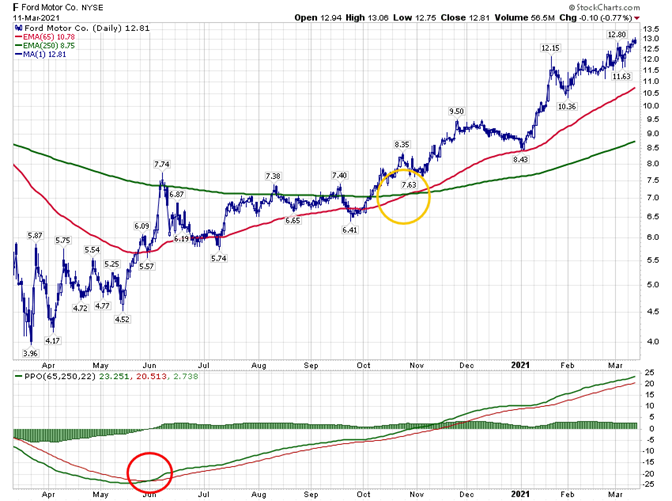

The chart of Ford is a good example. When you look at the PPO indicator on here, you are looking at the third number, 2.738 in this case.

The stock fell in March 2020 just as everything else did. As Ford rose, the 65EMA crossed above the 250EMA in October 2020. It is marked by the yellow circle. But notice down below on the PPO(65,250,22) where that crossed up in June circled in red. The PPO crossed up four months. Earlier than the 65/250 cross.

The PPO is important because in just those four months from the PPO cross up to the moving average cross up, Ford was up almost 40%. If you waited for the moving averages to cross up, you cost yourself that 40%.

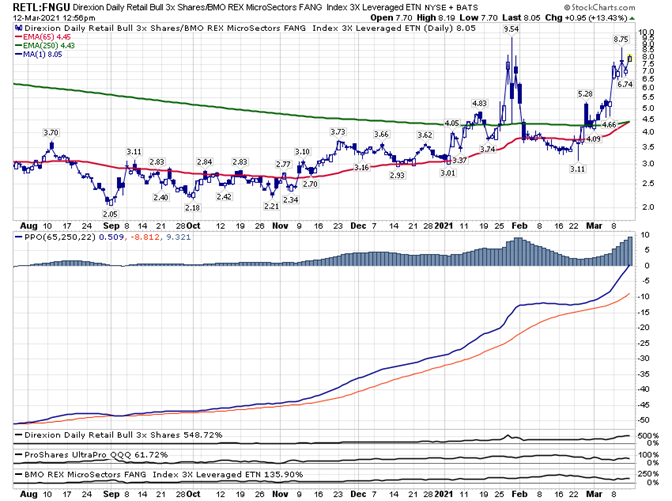

In another example using triple leverage ETFs, take a look at the chart of RETL since the PPO 22 crossed up back in July which is the very left edge of this chart. This chart shows the PPO (65,250,22) is currently at 9.321 (the third number is the indicator.)

Even though the 65 EMA is just now crossing over the 250EMA, RETL is up 548% while TQQQ is up only 61% and FNGU is up 135%. Any of these numbers is a good return, but 548% is “more better.”

This chart uses FNGU for the bottom symbol instead of TQQQ. You can use anything you like, but realize the denominator is what you are trying to outperform. If you are trying to outperform the Dow 30, then use $INDU. If you want to beat the S&P, use $SPX as the denominator. If you want to outperform ARKK, use ARKK.

As an aside, you can use this to cherry pick the stocks in any ETF. Use the ETF symbol as the denominator as in QQQ. You can then run ratio charts of each of the 100 stocks in QQQ and buy the individual stocks as the PPO 22 crosses up.

While the chart above applies to the 3X leveraged ETF, you would see the same result is you used the 1X versions FNGS:QQQ.

You will also find that when the PPO crosses down the numerator is under performing. The PPO crosses down before the moving averages do and gets you out of a falling position faster. And you certainly don’t want to own anything with a negative PPO whether is is a ratio chart or not.

While you can run the PPO charts as non-ratio charts, you will find you get better results when you use ratio charts. Though PPO is superior to MACD, a non-ratio chart can be positive for a utility stock. Utility stocks are not really known for growth or fast price appreciation. Even though you may get positive numbers for the PPO of non-ratio charts, you simply won’t see the same kind of returns.

We can see the ranking by PPO of the 3X ETFs I follow. This ranking would be the same for the 1X ETFs. This is the Non-Ratio version. Stockcharts won’t provide this screen for ratio charts, so check the actual ratio charts first.

HOW TO EASILY BEAT THE MARKET

One way to use the PPO is with the Dow 30. Everyone’s goal is to beat the Dow. If you can do that consistently, you would be celebrated. Back in the day, Bill Miller was the fund manager for the Legg Mason Capital Management Value Trust. His claim to fame was that he had outperformed the S&P for 15 straight years from 1991 to 2005. His streak ended in 2005. As a result, Bill Miller is no longer a portfolio manager. He is now a Philanthropist. Beating the market pays off.

If your target is the Dow 30 then using ratio charts of each stock in the index over the Dow 30 ($INDU) should give you a leg up. If you combine that by using crosses up of the PPO, you should outperform the Dow itself.

Here’s the current tally of buying the individual Dow stocks when the PPO crosses up. The performance numbers end 3/12/21. None of these stocks have yet to cross back down. The average return of these stocks more than doubled the Dow 30 return.

These cross ups were from individual Dow 30 Ratio charts as in V:$INDU, MMM:$INDU, etc. The only indicator was the PPO (65,250,22). The rest of the Dow 30 stocks have a negative PPO so aren’t listed here.

The list of all of the positive PPO stocks in the Dow. The PPO number is in the Name column. The CV:$INDU chart has a PPO of 02.78.

| RATIO CHART\ | NAME |

| CVX:$INDU | 02.78 – CVX:$INDU – Crossed up 11/16/20 |

| GS:$INDU | 02.29 – GS:$INDU – Crossed up 11/12/20 |

| AXP:$INDU | 02.02 – AXP:$INDU – Crossed up 11/9/20 |

| BA:$INDU | 01.90 – BA:$INDU – Crossed up 6/9/20 |

| INTC:$INDU | 01.83 – INTC:$INDU – ICrossed up 1/11/21 |

| JPM:$INDU | 01.74 – JPM:$INDU – Crossed up 10/9/20 |

| WBA:$INDU | 01.49 – WBA:$INDU – Crossed up 11/3/20 |

| CAT:$INDU | 01.20 – CAT:$INDU – Crossed up 6/5/20 |

| DIS:$INDU | 00.96 – DIS:$INDU – Crossed up 11/9/20 |

| TRV:$INDU | 00.77 – TRV:$INDU – Crossed up 11/21/20 |

| CSCO:$INDU | 00.57 – CSCO:$INDU – Crossed up 12/1/20 |

| MMM:$INDU | 00.22 – MMM:$INDU – Crossed up 2/4/21 |

| V:$INDU | 00.18 – V:$INDU – Crossed up 3/8/21 |

Let’s now get to the good stuff. How did each positive PPO stock do since the PPO crossed up? Pretty good, if you ask me.

| CROSS UP | RETURN | $INDU | ||||

| V | 3/8/2021 | 4.2% | 4.1% | |||

| MMM | 2/4/2021 | 6.3% | 6.7% | |||

| CSCO | 12/1/2020 | 14.4% | 10.6% | |||

| TRV | 11/21/2020 | 34.7% | 15.8% | |||

| DIS | 11/9/2020 | 54.7% | 15.7% | |||

| CAT | 6/5/2020 | 81.0% | 24.7% | |||

| WBA | 11/3/2020 | 51.9% | 21.7% | |||

| JPM | 10/9/2020 | 54.5% | 15.3% | |||

| INTC | 1/11/2021 | 22.5% | 5.4% | |||

| BA | 6/9/2020 | 16.8% | 18.9% | |||

| AXP | 11/9/2020 | 54.2% | 15.7% | |||

| GS | 11/12/2020 | 61.5% | 11.5% | |||

| CVX | 11/16/2020 | 38.3% | 11.2% | |||

| AVERAGE | 38% | 14% | ||||

| PPO OUTPERFORMED THE DOW 11 OF 13 TIMES | 84.6% | |||||

| PPO WAS PROFITABLE 13 OF 13 TIMES | 100.0% | |||||

| PPO AVERAGE RETURN OUTPERFORMED DOW 30 AVERAGE RETURN |

With just one simple indicator, you can easily outperform the Dow 30. With a little effort, you could do the same for any index as in QQQ, QQQJ, S&P 500, or even ARK ETFS. As we progress, I will be adding more PPO information on various lists.

Bitcoin

Since our last letter, institutional acceptance of Bitcoin continues to grow.

Paul Tudor Jones, $5.1 billion net worth legendary hedge fund manager, calls Bitcoin his #4 best inflation hedge. He revealed he bought $425 million in Bitcoin back in September.

Rapper Jay Z and Twitter CEO Jack Dorsey are establishing a bitcoin development fund. Together they are investing $23 million in bitcoin into the fund.

Morgan Stanley is conducting a review of Bitcoin in terms of including it in their $150 billion Counterpoint Global mutual fund asset management stable. If they ultimate decide to include Bitcoin, this puts additional pressure on other managers in terms of losing clients if they don’t also include Bitcoin.

Deutsche Bank announced in their December annual report they will be creating DB Digital Asset Custody to “develop a fully integrated custody platform for institutional clients and their digital assets providing seamless connectivity to the broader cryptocurrency ecosystem.”

Andrew Yang is running for mayor of New York City and has pledged to transform New York City into a hub for cryptocurrencies. Miami Mayor Francis Suarez pushed through a city commission resolution to look into paying employees in bitcoin as well as allowing residents to pay fees and taxes with bitcoin. The city commission passed a resolution 4:1 to encourage the Florida State Legislature to pass laws to allow Miami to invest some its treasury in bitcoin.

Canada has approved the first North American Bitcoin ETF which opens the door for U.S. regualtors to do so as well.

Apple agreed to include BitPay’s Prepaid Mastercard in the Apple Wallet. Apple Pay will now allow Bitcoin to be spent online, in stores, and in apps.

Bahamas Central Bank Digital Currency, The Sand Dollar, is pegged 1:1 to the Bahamian currency. The Bahamian dollar is pegged 1:1 to the US Dollar. People in the Bahamas now have the option of loading the Sand Dollar on their prepaid Mastercard and using it anywhere Mastercard is accepted.

Motley Fool, world’s fifth most visited financial website, announce they were buying $5 million in Bitcoin with a price target of $500,000. Bitcoin is now part of their 10X portfolio. They announced three core reasons: better store of value than gold, effective hedge against inflation, and has potential to become a transactional asset.

JPMorgan Feb 24, 2021: advises clients to move 1% into Bitcoin. “In a multi-asset portfolio, investors can likely add up to 1% of their allocation to cryptocurrencies in order to achieve any efficiency gain in the overall risk-adjusted returns of the portfolio. JPMorgan is saying bitcoin is a diversification tool even if you own just a little. JPMorgan has $3 Trillion under management. Just 1% of that, which they won’t achieve is $30 billion in new bitcoin purchases.

The moral of this story is that like it or not, Bitcoin is becoming mainstream. Serious institutional players are coming more and more on board. It seems to be gaining ground more as a diversifying asset class than as a medium of exchange.

Europe

The Netherlands Dow Jones Index and Dow Jones Portugal Index have both crossed up on the 220/440EMA.versus Gold. Many of them have crossed up on the Non Ratio charts.

Every European Index on my list except Portugal has crossed up on the PPO(65,250,22) ratio to Gold Charts: Denmark, Belgium, France, Switzerland, Germany, Units Kingdom, Greece, Finland, Spain, Ireland, Italy, Netherlands, and Switzerland.

Portugal crossed down on the PPO in late February.

Ranking the three strongest PPO’s:

- Greece

- Spain

- France

Bottom three PPOs ranked with worst at #1:

- Denmark

- Portugal

- Denmark

Interest Rates

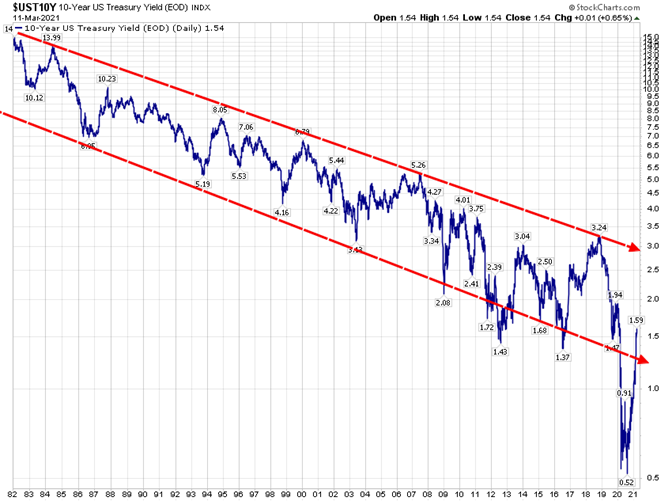

A lot has been made out of the 10 Year US Treasury note yield rising to as much as 1.6%. I don’t think it is a very big deal. Ten year rates have been falling in line with inflation for the last 40 years.\

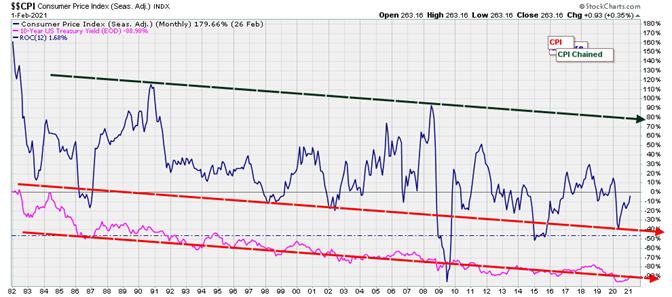

Below is a graph of the 12 month rate of change of inflation in blue and the 10 Year yield in pink. This is a 40-year chart. Notice the trend lines are almost completely parallel as they fall over the 40 years.

But as important, notice the wide range of yields the 10 year has over this time frame and how we are in the bottom third of that range. 10-year yields can go up much higher, even to 3.0% (see chart below), and still be in the 40-year downtrend while the inflation numbers stay subdued.

The talking heads are all about hype to get your eyes on their link. Any sign of an increase in the Ten Year Treasury Note gets them all hot and bothered.

Yes, the rate is higher now and above 1.5%. But the big picture tells an altogether different story. Take a look at the 40-year chart of 10-year yields. We have been on a downtrend due to inflation falling over that same 40-year period. Because of fears of deflation, yields fell below the range a few times with the largest drop just last year.

All the yield is doing is rising back into that 40-year downtrend. It is not signaling massive inflation. It is “normalizing.” We could even see it rise to the top of this long-term downtrend and approach 3%. We won’t see big inflation numbers until it crosses above 3% which it may never do again in our lifetimes.

. Dow Gold Ratio Strategy Rule 9

The market always makes a new high. Since 1792, when they founded the market under a Buttonwood tree in lower Manhattan, the market has had hundreds of selloffs, corrections, crashes, etc,. After each one, no matter what, they market ALWAYS makes a new high.

I started at EF Hutton in 1982. The day I started the Dow closed at 1005. I’ve seen lots of selloffs, the 1987 crash, the Dot Com bubble burst, the mortgage collapse in 2008, the March sell off in 2020. Every one of those events caused a subsequent new high in the Dow. If we get in another event, just wait for it. The new high is coming.

DOW GOLD RATIO STRATEGY RULES

- The strategy owns stocks and gold, no bonds.

- Any “experts” predictions of the future are guesses. As Cramer famously said, “They know nothing!”

- The Dow Gold Ratio Strategy focuses on what is happening right now. When that changes, we change.

- Your feelings about what might happen are your biggest enemy. Your opinion does not change what is happening in the market and doesn’t have any impact on what will happen.

- How you specifically measure the Dow Gold Ratio is not that important as long as your moving averages are long term. Each different set of moving averages will give you different entry and exit dates. When a trend lasts years, the actual day you enter just isn’t that important.

- The strategy does not try to keep you out of short-term corrections.

- Gold is the preferred alternative to stocks, not bonds.

- The object is to have profitable trades, not hit the tops and bottoms.

- The market ALWAYS makes a new high.

1X – DOW GOLD TRACK RECORD (220 EMA/440 EMA)

5/19/1977 to 2/15/1982 DOWN Gold +122% (Dow -15%)

2/15/1982 to 12/29/1987 UP Dow +141% (Gold 53%)

12/29/1987 to 10/10/1988 DOWN Gold -16% (Dow +11%)

10/10/1988 to 10/09/2001 UP Dow +321% (Gold -29%)

10/09/2001 to 3/08/2013 DOWN Gold +437% (Dow +59%)

3/08/2013 to 10/09/2019 UP Dow +84% (Gold -4%)

10/09/2019 to 2/26/2021 DOWN Gold +15% (Dow +18%)

1X – DOW/QQQ/GOLD TRACK RECORD (220 EMA/440 EMA) Using QQQ instead of Dow

5/19/1977 to 2/15/1982 DOWN Gold +122% (Dow -15%)

2/15/1982 to 12/29/1987 UP Dow +141% (Gold 53%)

12/29/1987 to 10/10/1988 DOWN Gold -16% (Dow +11%)

10/10/1988 to 10/09/2001 UP Dow +321% (Gold -29%)

10/09/2001 to 3/08/2013 DOWN Gold +437% (Dow +59%)

3/08/2013 to 8/16/2019 UP QQQ +333% (Gold +27%)

8/16/19 to 2/26/2021 UP QQQ +71% (Gold +13%)

3X – DOW/QQQ GOLD TRACK RECORD (220 EMA/440 EMA) – Using TQQQ instead & Leverage

5/19/1977 to 2/15/1982 DOWN Gold +122% (Dow -15%)

2/15/1982 to 12/29/1987 UP Dow +141% (Gold 53%)

12/29/1987 to 10/10/1988 DOWN Gold -16% (Dow +11%)

10/10/1988 to 10/09/2001 UP Dow +321% (Gold -29%)

10/09/2001 to 12/02/2008 DOWN Gold +167% (Dow -7%)

12/2/2008 to 3/08/13 DOWN UGL +208% (QQQ +167%)

3/8/13 to 2/26/2021 UP TQQQ +3476% (UGL -27%)

DOW GOLD RATIO STRATEGY: How we use it

Using $SPX:$Gold, $INDU:$GOLD, and QQQ:$Gold ratio charts, we first examine each major index. Those that are down versus $Gold (220 EMA is below the 440 EMA) are excluded. Next, we use the ratio charts: QQQ:$SPX, QQQ:$INDU, $SPX:$INDU to choose the best index to follow. Today, the $SPX:$Gold and $INDU:$Gold ratio charts are “down” and QQQ:$Gold is the only one “Up” so we know the QQQ:$SPX and QQQ:$INDU charts will result in QQQ being the winner.

For those whose strategy doesn’t include leverage, QQQ is the choice.

For more adventurous investors, TQQQ and its derivative brother FNGU are the choice.

The strategy from here is pretty simple. We hold our positions until the charts tell us to do otherwise. It’s boring, though sometimes scary as in March 2020, but it gives you what you want: great returns.

GLOSSARY

1X – Unleveraged ETFs

2X – ETFs internally leveraged 2:1

3X – ETFs internally leveraged 3:1

Basis Point (bp) – 1 percent is made up of 100 basis points. 75bp is 0.75%

Crossing or crossed – the day that one moving average crosses either up or down versus the other moving average. When I say the 65/250 crossed up, that means the 65 EMA crossed above the 250 EMA on the chart.

EMA – Exponential Moving Average – SMA – Simple Moving Average. A 65EMA is a 65 day exponential moving average. Expontial moving averages work just as simple moving averages do except there is overweighting on the most recent days.

Margin – this is a dirty word and you should never ever ever use it.

$INDU – This is symbol Stockcharts.com uses for the Dow Jones 30 Industrial Average

$SPX – This is the symbol Stockcharts.com uses for the Standard & Poor’s 500 index

PPO – Percent Price Oscillator is a moving average based indicator. I use the PPO (65,250,22) version which is the 65 day EMA over the 250 day EMA with a 22 month moving average. It first calculates the difference between the value of the 65 day EMA and the value of the 250 day EMA and converts that difference to a percent of the stocks price. It plots that difference on your chart then adds a 22 day moving average of that plot.

Ratio Chart – a chart that plots the price of the first symbol divided by that of the second symbol. The ratio chart of $INDU:$Gold is one of the price of the Dow in points is divided by the price of $Gold. If that chart is trending up, $INDU is outperforming $gold. If that chart is trending down, then $Gold is the winner.

UP & DOWN – means a ratio chart where the first moving average is plotting above the second moving average. In our 220/440 strategy, that would mean the 220 EMA is above the 440 EMA on the chart. QQQ is outperforming $Gold so you would expect the 200 EMA to be above the 440 EMA.

Whipsaw – when we get a cross up or down that reverses with a cross the other way in a very short period of time.

NOTES: This newsletter is a free service. Please pass this on to your friends, colleagues, and your broker. If you received your copy that way and would like a free subscription, or have comments or questions, send me an email at Dowgoldratiostrategy@gmail.com

If you are an Amazon Prime subscriber, my book, “Dow Gold Ratio Strategy” is available as a free Kindle Reader version. For those of you not Prime members, the book is $19.95